IRS CLARIFIES SECTION 6055 REPORTING FOR HRAs

On Sept. 17, 2015, the IRS issued 2015 final instructions for Forms 1094-B and 1095-B, as well as instructions for Forms 1094-C and 1095-C. The finalized instructions provide clarification on Section 6055 reporting requirements for employers that provide health reimbursement arrangements (HRAs) to their employees.

The previous draft instructions indicated that separate Section 6055 reporting would be required for HRAs offered by employers that also offered insured major medical plans.

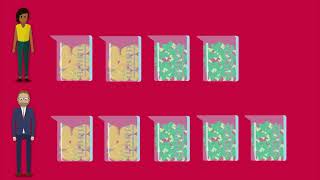

The final instructions clarify that an employer with an insured major medical plan and an HRA is not required to report coverage under the HRA if the eligible individuals are enrolled in the insured major medical plan. However, employers must report HRA coverage for eligible individuals who are not enrolled in their employers’ major medical plans (for example, employees who are enrolled in a spouse’s plan).