Confused about Essential Health Benefits?

- Jul 8, 2014

- 2 min read

You’re probably familiar with the Essential Health Benefit (EHB) and cost-sharing requirements that took effect in 2014, but if you have questions about them, you’re not alone. We continue to get many questions about these topics, and we’ve answered a few of the most common ones here.

Frequently Asked Questions

Do large group or self-funded plans have to cover pediatric dental or vision benefits? Generally, no, large group and self-funded plans do not have to cover pediatric dental or vision. However, if you have self-funded, non-excepted dental/vision (employees automatically receive dental and/or vision benefits when they enroll in medical), many dental and vision services provided to enrollees under age 19 would be considered EHBs and thus must be covered with no annual or lifetime dollar maximums, and customer expenses, such as copays, must count toward your overall out-of-pocket (OOP) maximum across all benefits. However, if your employees can decline the self-funded dental/vision coverage, then your plan is excepted and the PPACA requirements do not apply.

Can employer contributions to employee accounts be used to increase the medical OOP maximum?

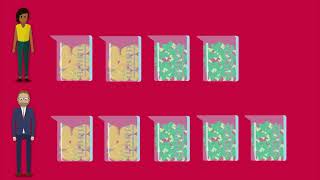

No. The OOP maximum cannot be higher than the allowed limits ($6,350 individual/$12,700 family for 2014 plan years) even if the employer contributes to an account (FSA/HRA/HSA) on the employee’s behalf.

For example, the OOP maximum cannot be $6,850 even if the employer contributes $500 to an employee’s HSA account.

The law states that copays must apply to the OOP maximum, but if the OOP is $0, then copays would have nothing to apply to. Is a zero OOP maximum allowed? No. Beginning in 2014, all non-grandfathered plans must have an OOP maximum on the medical benefits if there are any customer copays, deductibles or coinsurance.

Will the OOP maximum amounts increase for 2015? Yes. The 2015 limits are $6,600 for an individual and $13,200 for a family.

If my plan year begins on July 1, when do I need to begin counting my prescription drug coverage that is provided by a different vendor toward my medical plan OOP maximum? For 2014, plans with multiple service providers (carve out vendors) are not required to have an OOP maximum for the pharmacy benefit if they don’t already have one. For plans that have an existing OOP maximum, neither the medical nor pharmacy OOP maximum may exceed the PPACA limit. In this case, the pharmacy OOP maximum can be $6,350/$12,700 and the medical OOP maximum can also be $6,350/$12,700.

Comments