Draft IRS Information Reporting Forms Available for Employers and Insurers

- stacy174

- Jul 24, 2014

- 2 min read

On July 24, 2014, the Internal Revenue Service (IRS) released draft forms for reporting health insurance coverage offered by applicable employers, and minimum essential coverage offered by insurers and employers of self-insured plans.

The draft forms at IRS.gov/draftforms are currently informational only and are intended to help employers begin preparing for data requirements. Final versions and detailed instructions will be posted at a later date. The first reporting is required in early 2016 for the 2015 calendar year; however, employers are encouraged to voluntarily report coverage information in 2015 for the 2014 calendar year.

While these reporting requirements are not mandatory until 2016, certain components of the law require actions this year. Because Social Security Numbers (SSNs) are the primary identifying data used by the IRS, reporting entities are required to make “reasonable attempts” to obtain SSNs that aren’t on file for covered employees or dependents. “Reasonable attempts” are defined as three attempts via electronic, paper, or telephonic outreach. These attempts must be made by certain dates, starting this year. If the SSN is not obtained after making the three attempts, reporting entities may use the date of birth for any of those covered individuals.

A brief summary of the required reporting follows:

Reporting on the Individual Mandate

Insurers and employers of self-insured plans (regardless of size) must report annually to both the IRS and any individual named in the report, whether the individual had minimum essential coverage. The IRS will use this information to confirm which individuals have complied with the “individual mandate.” When employers self-insure their plans, they may report on compliance with both the individual and employer mandates on one form.

Reporting on the Employer Mandate

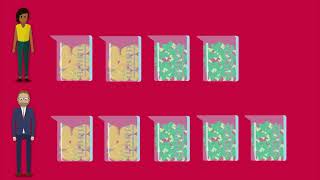

Employers with 50 or more full-time employees (including full-time equivalents) need to report on all of the employees offered coverage during the prior calendar year. This information must be provided to the IRS and all employees identified as being offered employer-sponsored health coverage.

Draft Forms

The forms are to be completed and filed as follows:

Employers will file Form 1094-C (a transmittal/cover sheet) to the IRS only, and Form 1095-C to both the IRS and named individuals. If its plan is insured, the employer will only complete Parts I and II of Form 1095-C.

Insurers will send Form 1094-B (a transmittal/cover sheet) to the IRS only, and Form 1095-B to both the IRS and named individuals for insured coverage only.

Comments