WHAT YOUR EMPLOYEES NEED TO KNOW ABOUT HEALTHCARE REFORM

- Jan 15, 2015

- 1 min read

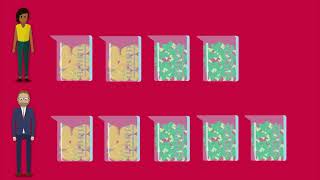

Under the Affordable Care Act (ACA or health care reform law), U.S. citizens and legal residents must have basic health insurance or face a penalty. This basic insurance is called minimum essential coverage (MEC). Many people already get coverage that counts as MEC through their employers. Those who don’t have it may have to pay a penalty to the Internal Revenue Service (IRS). It’s called the individual shared responsibility payment. The penalty starts with the 2014 tax year and will be due when tax returns are filed in 2015.

What this means for group members…

When group employees file their personal 2014 federal income tax returns in 2015, they’ll need to select a box to indicate whether they had health care coverage all year. If they didn’t have coverage, even for part of the year, they may owe a penalty. If they don’t pay the penalty, the IRS will deduct it from any refund they’re due.

Comments