DID YOU KNOW?

- stacy174

- Jul 15, 2015

- 1 min read

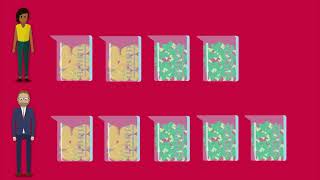

The ACA’s excise tax on high-cost employer health plans (or the “Cadillac tax”) is set to take effect in 2018. Under this provision, employer coverage that exceeds certain dollar limits will be subject to a 40-percent excise tax.

Bipartisan support is currently growing for a repeal of the Cadillac tax. Those who are advocating for repeal assert that the tax is no longer needed to help keep health care costs in check. They also argue that it will lead to reduced or eliminated benefits and higher costs for employees.

With repeal far from certain, employers are already planning ahead for 2018 and making adjustments to benefits offerings to avoid the tax penalty.

Comments