U.S. SUPREME COURT UPHOLDS ACA SUBSIDIES IN FEDERAL EXCHANGES

- stacy174

- Jul 15, 2015

- 4 min read

On June 25, 2015, the U.S. Supreme Court issued a final ruling in King v. Burwell. This case challenged the availability of health insurance Exchange subsidies in states with Exchanges run by the federal government.

In a 6-3 decision, the Court held that, in drafting the Affordable Care Act (ACA), Congress intended for the federal government to provide subsidies in all states—those that established their own Exchanges and those that have federally facilitated Exchanges, or FFEs.

According to the Supreme Court, without the availability of these subsidies in all states, several other key ACA provisions would not operate as intended (including the individual mandate and the employer shared responsibility rules). The Court’s ruling means that subsidies are available in all states, including those with FFEs.

Health Insurance Exchanges and Subsidies

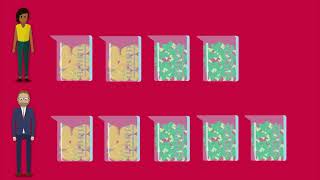

The ACA requires each state to have an Exchange for individuals and small businesses to purchase private health insurance. The ACA delegated primary responsibility for establishing the Exchanges to each individual state. However, the Department of Health and Human Services (HHS) operates an FFE in any state that refuses or is unable to set up an Exchange. For 2015, only 13 states and the District of Columbia established their own Exchanges. HHS operates FFEs in the remaining states (with state assistance in some cases—but in most cases, with no state assistance).

The ACA also created health insurance subsidies to help eligible individuals and families purchase coverage through an Exchange. The subsidies are designed to make Exchange coverage more affordable by reducing out-of-pocket health care costs.

Of the approximately 11 million people who selected private health plans during the 2015 open enrollment period, nearly 9 million obtained coverage through an FFE. According to HHS, 87 percent of Exchange consumers have been determined to be eligible for subsidized insurance.

Overview of King v. Burwell

King v. Burwell is one of several lawsuits that were filed in response to an IRS rule authorizing subsidies in all states, including those with FFEs. These cases challenged the ability of the federal government to provide subsidies to individuals in states with FFEs.

This case was filed by four individuals who live in a state with an FFE. They argued that the IRS rule authorizing subsidies in all states conflicts with the text of the ACA. They asserted that, according to the law’s plain language, the ACA only authorized subsidies to be provided in states that have established their own Exchanges.

Although the Supreme Court agreed that text of the ACA is ambiguous, it noted that the ACA’s subsidy provision must be read in a manner “that is compatible with the rest of the law.”

If subsidies were not available in federal Exchanges, the Supreme Court concluded that “it would destabilize the individual insurance market in any State with a Federal Exchange, and likely create the very ‘death spirals’ that Congress designed the Act to avoid.” Also, if the federal government was unable to provide subsidies in states that have FFEs, the Court asserted that several other key ACA provisions would not operate as intended.

For example, the individual mandate “would not apply in a meaningful way, because so many individuals would be exempt from the requirement without the tax credits.” In addition, because the employer shared responsibility penalties are triggered only when an employee receives a premium tax credit, those penalties would not apply in any states where the subsidies were unavailable.

Therefore, according to the Supreme Court, it “stands to reason that Congress meant for those [subsidies] to apply in every state.”

A number of similar lawsuits are still pending in federal courts. These courts are required to follow the Supreme Court’s ruling when issuing their decisions. Therefore, it is expected that the decisions in other cases will be consistent with the Supreme Court’s ruling.

Impact on Employers

While the case was pending, the Obama Administration continued to make federal subsidies available to eligible individuals in all states, including those with FFEs.

On Nov. 7, 2014, the White House posted a statement, mirroring an earlier IRS statement, to confirm that nothing changed for individuals receiving advance payments of the premium tax credit and that tax credits remained available.

Because the Supreme Court ruled that ACA subsidies are available in all states, including those with FFEs, eligible individuals in all states may continue to receive subsidies for their Exchange coverage.

A ruling that struck down the availability of subsidies in FFEs would have had significant implications for employers as a result of the ACA’s employer mandate. Under the employer mandate, certain large employers may face penalties if they do not offer coverage to their full-time employees that meet certain requirements. These penalties apply only if an employee receives a subsidy to buy coverage through an Exchange.

If the subsidies were available only in state-based Exchanges, employers would not be subject to penalties for employees living in states with an FFE. However, because the subsidies remain available in all states, the employer shared responsibility penalties will still apply for employers in all states.

More Information

Please contact 360benefits for more information on the ACA’s federal subsidies or the employer mandate.

Comments