KNOWING THE DIFFERENCE BETWEEN EXEMPT AND NONEXEMPT

The federal Fair Labor Standards Act (FLSA) requires employers to pay all employees at least the minimum wage for all hours worked, and, one and one-half times the employee’s regular wage rate for any hours worked over 40 in a workweek. However, if an employee meets the requirements of one of the FLSA’s exemptions, the employee may not have to be paid minimum wage or for overtime (as they are considered “exempt” from this requirement).

Classifying an employee as exempt, however, is more than just a matter of preference. The FLSA has several specified exemptions, each with its own requirements that need to be satisfied in order to properly use the exemption. Classifying an employee as exempt when the requirements are not met can result in significant liability for the employer.

Recently, an HR consulting firm was found to owe $1 million in overtime wages and damages to employees after a DOL investigation discovered FLSA violations.

The consulting firm misclassified employees as exempt based on the belief that employees being paid a certain salary means that the employees aren’t entitled to overtime pay.

The fact that an employee is paid on a salary basis is not an automatic exemption from the FLSA’s overtime pay requirements. Most of the FLSA exemptions require that an employee be paid a minimum salary and the employee must spend a certain amount of time performing specified job duties.

For example, the exemption for administrative employees requires that employees be compensated on a salary basis and the salary must meet at least the minimum amount specified. In addition, employees must be primarily engaged in office or non-manual work directly related to management or general business operations, and the employees must exercise discretion and judgement with respect to matters of significance.

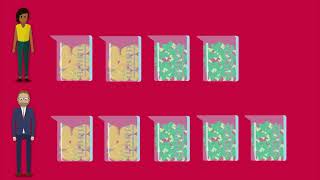

An employer is able to classify a position as nonexempt even if the requirements for an exemption are satisfied. However, an employer may not classify a position as exempt unless all of the necessary criteria are satisfied.

Employers are encouraged to review their current exempt-level positions against the FLSA requirements for the exemption.