IRS ANNOUNCES HSA/HDHP LIMITS FOR 2017

- stacy174

- Jul 13, 2016

- 1 min read

The IRS has released the inflation-adjusted limits for HSAs and HDHPs for 2017. These limits include: (1) the maximum HSA contribution limit; (2) the minimum deductible amount for HDHPs; and (3) the maximum out-of-pocket expense limit for HDHPs. The HDHP limits will not change for 2017 plan years. The only limit that will change for 2017 is the HSA contribution limit for individuals with self-only coverage under an HDHP, which will go up by $50.

Because the limits for HDHPs will not change for 2017, employers that sponsor these plans will not need to make plan design changes to comply with the IRS’ rules for HDHP minimum deductibles and maximum out-of-pocket limits. However, if an employer communicates the HSA contribution limits to individuals as part of the enrollment process, these enrollment materials should be updated to reflect the increased limit that will apply to individuals with self-only HDHP coverage for 2017.

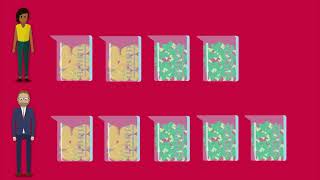

The following chart shows the HSA/HDHP limits for 2017 as compared to 2016. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

Comments