NEW STAND-ALONE HRA OPTION AVAILABLE FOR ELIGIBLE SMALL EMPLOYERS

- Dec 13, 2016

- 2 min read

Due to the Affordable Care Act (ACA), most stand-alone health reimbursement arrangements (HRAs)—an HRA that is not offered in conjunction with a group health plan—have been prohibited since 2014. However, on Dec. 13, 2016, the 21st Century Cures Act (Act) was signed into law, which allows small employers that do not maintain group health plans to establish stand-alone HRAs, effective for plan years beginning on or after Jan. 1, 2017.

This new type of HRA is called a “qualified small employer HRA” (or QSEHRA). Like all HRAs, a QSEHRA must be funded solely by the employer. Employees cannot make their own contributions to an HRA, either directly or indirectly through salary reduction contributions. Specific requirements apply, including a maximum benefit limit and a notice requirement.

Who is eligible?

To be eligible to offer a QSEHRA, an employer must meet the following two requirements:

The employer is not an applicable large employer (ALE) that is subject to the ACA’s employer shared responsibility rules.

The employer does not maintain a group health plan for any of its employees.

What is the maximum benefit limit?

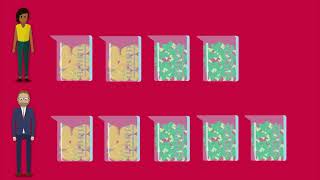

The maximum benefit available under the QSEHRA for any year cannot exceed $4,950 (or $10,000 for QSEHRAs that also reimburse medical expenses of the employee’s family members). These dollar amounts are subject to adjustment for inflation for years beginning after 2016. Additionally, the maximum dollar limits must be prorated for individuals who are not covered by the QSEHRA for the entire year.

What is the notice requirement?

An employer funding a QSEHRA for any year must provide a written notice to each eligible employee. This notice must be provided within 90 days of the beginning of the year. For employees who become eligible to participate in the QSEHRA during the year, the notice must be provided by the date on which the employee becomes eligible to participate.

Transition Relief Extension

The Act also extends the transition relief under IRS Notice 2015-17, so that it applies with respect to plan years beginning on or before Dec. 31, 2016.

Comments